Subject: Two Option Trades of the Week - GE and SCHW

October 31, 2023

Dear Friend,

Happy Halloween!

I haven’t written in a couple of weeks since credits weren’t close enough to my target entry prices when I initially sent the trades to my subscribers. However, the credit for last week’s trade on Charles Schwab (SCHW) has come back and now exceeds my initial target.

So, I figured why not send it now since I still like the setup. I’m not changing the initial write-up that I sent to my Saturday Report subscribers on October 21, so it may sound a bit outdated. But the trade is still a good play.

Moreover, this week’s trade credit is a little above my entry level, so it’s good to go as well. So, you’re getting a first this week – two trades. Both bearish call credit spreads on stocks after they reported earnings.

Before I get to the trades, I want to let you know that our Terry’s Tips portfolios have caught fire in the past couple of weeks. We’re up 7% for the past two weeks while the S&P 500 fell nearly 5%. Our recent surge has pushed our overall return to more than triple that of the S&P this year.

I'm also happy to highlight our Microsoft (MSFT) portfolio, which gained 14% just last week alone and 40% over the past four weeks. It’s now up 65% for the year and is challenging our QQQ portfolio, which is up more than 70%!

How long can you afford to miss out on these profits? For our loyal newsletter subscribers (that’s you), I’m of course keeping the sale going that saves you more than 50% on a monthly subscription to Terry's Tips.

You’ll get …

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions. Trade one portfolio or all four. It’s up to you.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week's trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

To become a Terry's Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, keep all the valuable reports.

I look forward to having you join in the fun and profits! Now on to the trades, starting with the previous week's trade ...

Avast Ye Schwabs

Two call spreads in Estee Lauder (EL) and the SPDR Healthcare ETF (XLV) expired worthless yesterday for gains of 25% apiece. To be fair, our bullish spread on Lululemon Athletica (LULU) expired in the money a week earlier for a larger loss. But the LULU misstep interrupted a string of seven straight winners. A large part of this success has been due to taking a more bearish stance toward the market. In fact, today’s trade marks the fifth straight bearish call spread and eighth of the past 11. And with good reason, as our only losses of the past two months have been bullish positions. We’re on a solid roll. I hope you’re banking some winners.

With earnings season hitting full stride this week, there’s no end to the trade possibilities. Of course, there were the spotlight names, such as Tesla (TSLA) and Netflix (NFLX), whose large post-earnings moves grabbed headlines. But I prefer stocks that have smaller, off-the-radar moves that have a lower likelihood of reversing. One such stock is Charles Schwab (SCHW), which is no stranger to these pages (you may recall I had a few issues with the TD transition in September).

SCHW reported before the open on Monday, so we had a whole week’s worth of post-earnings price action to digest. The numbers were mixed, with net income coming in slightly ahead of expectations while revenue fell a bit short. However, both numbers fell far short of last year’s figures. I won’t bore you by parsing through all the individual data points (bank deposits, net interest revenue, TD migration, new brokerage accounts, etc.). Analysts seem to feel that SCHW still faces several short-term hurdles that have buffeted it all year, though the longer-term prospects are encouraging.

Speaking of analysts, their reaction was much like SCHW’s earnings … mixed. There were no ratings changes while target price changes went both ways. But analysts are clearly bullish on SCHW, giving it a solid buy rating on average. The average target price is near $70, which is around 35% above Friday’s close. This fits into the struggle now, prosper later narrative I mentioned above. But since we’re looking ahead only a few weeks, the bearish case makes more sense.

On the chart, the stock reacted positively to earnings, popping 6% in Monday’s trading before settling for a 4.7% gain. But that was the high close of the week, as the shares tumbled more than 5% after Monday. It’s notable that the 20-day moving average provided staunch resistance throughout the week, containing the initial Monday burst and then sending the stock lower through the week’s end. The 20-day has done a solid job keeping the current decline intact since it rolled over in May. I’ll also note that the stock enjoyed a massive 12.6% spike after its previous earnings report in July, only to give it all back during the subsequent month.

If you agree that the stock will continue its downtrend based on the resistance from its 20-day moving average, consider the following credit spread trade that relies on SCHW staying below $53 through expiration in 6 weeks:

Buy to Open the SCHW 1 Dec 56 call (SCHW231201C56)

Sell to Open the SCHW 1 Dec 53 call (SCHW231201C53) for a credit of $0.75 (selling a vertical)

This credit is $0.09 less than the mid-point price of the spread at Friday’s $50.87 close. Note that I’m giving a little extra room on the entry credit. Unless SCHW falls sharply at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $73.70. This trade reduces your buying power by $300, making your net investment $226.30 per spread ($300 - $73.70). If SCHW closes below $53 on Dec. 1, the options will expire worthless and your return on the spread would be 33% ($73.70/$226.30).

Here's this week's trade ...

Low Voltage

We had another spread expire worthless on Friday, but it made us sweat. Adobe (ADBE) was looking great, which was saying something as our only open bullish position. It hit an annual high on Oct. 12, putting the short put nearly 15% out of the money. Then the falling market tide grabbed the stock and pulled it down to within eight points of the short strike at Friday’s close. Another day and it might have moved into the money. But it didn’t and we bagged a gain of over 30% for our eighth winner of the past nine closeouts. That leaves us with five open positions, all bearish call spreads.

I’d love to add a put spread this week, but I can’t make a case for fighting the bearish tape. Maybe next week. For this week, I had way too many earnings plays to choose from, as this was the busiest week of the season. Frankly, I stopped looking after an hour, realizing that I could have spent all day analyzing dozens and dozens of top names.

I settled on General Electric (GE), which may seem like an odd choice given that it had a blowout report and had its best post-earnings day in years. The company easily beat earnings and revenue estimates and raised earnings and revenue growth guidance for 2023. The stock responded with a 6.5% pop on Tuesday, its largest gain after earnings since Jan. 2020. What’s not to like, right?

Well, analysts didn’t seem overly excited. In fact, only two weighed in with target price increases of $1 and $2. That’s it. The average target sits near $126, which is around 19% above Friday’s close. I’ll also point out the last time GE saw $126 was six years ago. There were no ratings changes, which were already heavily slanted toward the buy level. This does not seem like a hearty endorsement of a stock that just had as good an earnings report as you’ll see.

While the shares enjoyed a big gain on Tuesday, the rest of the week didn’t go well. In fact, the stock closed out the week below the pre-earnings close. The dual resistance of the 20-day and 50-day moving averages were in play, as the stock closed the week below both. These trendlines have rolled over into declines, a bad sign given that the stock doesn’t stray far from either. Another factor to note: GE had a big pop of more than 6% after the previous earnings release, but the stock drifted lower after that first day and has never closed a day higher since.

It seems that the earnings effect lasted all of one day and the stock has resumed its downtrend that’s been in place for six weeks. This trade is a bet that the trend will continue, especially in light of the broader market’s weakness. Note that the short call strike sits above Tuesday’s close and the mid-October peak.

If you agree that the stock will continue its downtrend based on the resistance from its 20-day (blue line) and 50-day (red line) moving averages, consider the following credit spread trade that relies on GE staying below $114 (green line) through expiration in 6 weeks:

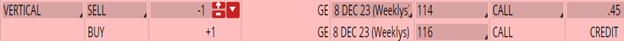

Buy to Open the GE 8 Dec 116 call (GE231208C116)

Sell to Open the GE 8 Dec 114 call (GE231208C114) for a credit of $0.40 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $106.35 close. Note that I’m giving a little extra room on the entry credit. Unless GE falls sharply at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $38.70. This trade reduces your buying power by $200, making your net investment $161.30 per spread ($200 - $38.70). If GE closes below $114 on Dec. 8, the options will expire worthless and your return on the spread would be 24% ($38.70/$161.30).

Good luck with these trades,

Remember to click here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off.

Any questions? Email Jon@terrystips.com. Thank you again for being a part of the Terry's Tips newsletter.

Happy trading,

Jon