Subject: Trade of the Week - Attention Shoppers

January 9, 2023

Dear Friend,

Here is your Option Trade of the Week, generated by our trading team, for your consideration. We’re going with another ETF this week, but this time back on the bearish side.

Before getting to the trade, there’s still time to jump on our huge discount offer to join Terry's Tips as an Insider Member that lets you trade up to four portfolios. These portfolios use our proprietary 10K Strategy, which has generated average annual gains of 60% for the past five years in actual brokerage accounts (including all commissions). In 2022, our portfolios beat their underlying stock performance by an average of 22%.

We're still running a special new-year sale that saves you more than 50% on a monthly subscription to Terry's Tips. For just $98, you'll get:

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week's trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

To become a Terry's Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, still keep all the valuable reports.

We look forward to having you join us in 2023! Now on to the trade ...

Attention Shoppers

With earnings reports non-existent, we’re sticking with ETFs again this week, this time on the bearish side with the retail sector. The SPDR S&P Retail ETF (XRT) is a broad-based, equal-weighted index of around 100 retail stocks. No stock is worth more than 1.5% of the portfolio and the top 10 holdings are littered with small niche names, some of which I’ve frankly never heard of (Sally Beauty, Franchise Group, Leslie’s). Amazon and Costco, on the other hand, make up a mere 2.2% combined.

XRT had a rough 2022, losing about a third of its value. That puts it on par with tech stocks, which it is not, and trailing the broader market. Should we expect a rebound in 2023? I won’t hazard a guess. But we know the Fed will continue to raise rates to tame inflation. Many expect some sort of recession. The outlook appears muddy at best and bearish at worst.

XRT has staged a mini-rally to start 2023, gaining 3.8% in the first week. But the ETF is now bumping into its 50-day moving average. However, the 50-day hasn’t provided much resistance or support for the past several months. Of greater concern is the overhead 200-day moving average, which has been declining for more than a year. This trendline marked a top in August and kept XRT in check in November, allowing just two daily closes above it.

This bearish trade is a play on XRT once again faltering at the 200-day, which sits 3.7% above the Friday closing price. Note that the short call strike of our spread (red line) sits above the 200-day (blue line), meaning this resistance will need to be broken to move the spread into the money. Options traders have a similar outlook, pricing puts higher than equidistant out-of-the-money calls.

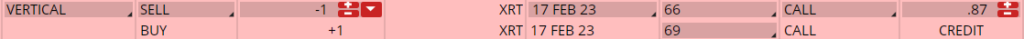

If you agree that XRT will fail to overtake the 200-day, consider the following trade that relies on the ETF staying below $66 through expiration in 6 weeks:

Buy to Open the XRT 17 Feb 69 call (XRT230217C69)

Sell to Open the XRT 17 Feb 66 call (XRT230217C66) for a credit of $0.85 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Monday’s $62.46 close. Unless XRT drops quickly, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $83.70. This trade reduces your buying power by $300, making your net investment $216.30 per spread ($300 - $83.70). If XRT closes below $66 on Feb. 17, both options will expire worthless and your return on the spread would be 39% ($83.70/$216.30).

Testimonial of the Week

I have been a subscriber for about a year. I autotrade in 2 different accounts, all your strategies. I read everything you write on Saturdays. I love your happiness thoughts and everything else. I usually do not communicate at all but I had to tell you how well my accounts with you are doing compared to everything else. You are awesome. Keep up the good work. Thank you. ~ Maya

Thank you again for being a part of the Terry's Tips newsletter. Any questions? Email Terry@terrystips.com

Happy trading,

Terry