Subject: Tarnished Goldman

January 24, 2023

Dear Friend,

Here is your Option Trade of the Week, as given to our Terry's Tips Insider Members as part of the Saturday Report. With earnings season underway, we’re back to our typical earnings plays with a return to the bearish side.

Before getting to the trade, there’s still time to jump on our huge discount offer to join Terry's Tips as an Insider Member that lets you trade up to four portfolios. These portfolios use our proprietary 10K Strategy, which has generated average annual gains of 60% for the past five years in actual brokerage accounts (including all commissions). In 2022, our portfolios beat their underlying stock performance by an average of 22%.

We're still running a special new-year sale that saves you more than 50% on a monthly subscription to Terry's Tips. For just $98, you'll get:

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week's trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

To become a Terry's Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, still keep all the valuable reports.

We look forward to having you join us in 2023! Now on to the trade ...

Tarnished Goldman

With earnings season now underway, we can focus on companies that have recently reported. Though the docket was sparse this past week, there were a few juicy names to choose from. One was Goldman Sachs (GS), which reported a miserable quarter before the week’s trading began on Tuesday.

Earnings plunged 66% from a year earlier on slower corporate dealmaking and 48% lower investment banking fees. Earnings per share came in at $3.32, far below the expected $5.56. FactSet noted it was the bank’s largest miss in years. Revenue also dropped and missed estimates.

The stock reacted by falling 6.4% on Tuesday, its second-largest one-day, post-earnings decline since April 2009. The week didn’t get any better for GS, as reports came in on Friday that the Federal Reserve is investigating whether the bank had the appropriate safeguards in its consumer business. The stock fell 2.5% on a day when stocks were higher.

The stock’s 8.6% plummet last week pulled it below its 20-day and 50-day moving averages. The 50-day is rolling over into a decline for the first time in three months, while the 20-day appears poised to head lower as well. We are going with a bearish call spread, with the short call strike sitting between the 20-day (blue line) and 50-day (red line) trendlines. However, given the 50-day’s current path, it should fall below this strike and serve as a second potential point of resistance to keep the spread out of the money.

If you agree that GS will continue to struggle, consider the following trade that relies on the stock staying below $360 (green line) through expiration in 6 weeks:

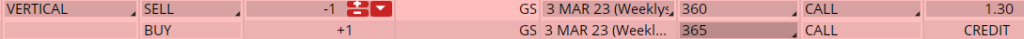

Buy to Open the GS 3 Mar 365 call (GS230303C365)

Sell to Open the GS 3 Mar 360 call (GS230303C360) for a credit of $1.25 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $341.84 close. Unless GS falls quickly, you should be able to get close to that price. The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $123.70. This trade reduces your buying power by $500, making your net investment $376.30 per spread ($500 - $123.70). If GS closes below $360 on Mar. 3, both options will expire worthless and your return on the spread would be 33% ($123.70/$376.30).

Any questions? Email Terry@terrystips.com

Testimonial of the Week

I have been a subscriber for about a year. I autotrade in 2 different accounts, all your strategies. I read everything you write on Saturdays. I love your happiness thoughts and everything else. I usually do not communicate at all but I had to tell you how well my accounts with you are doing compared to everything else. You are awesome. Keep up the good work. Thank you.

~ Maya

Any questions? Email Terry@terrystips.com.

Thank you again for being a part of the Terry's Tips newsletter.

Happy trading,

Terry