Subject: Option Trade of the Week – Where’s the Beef?

October 10, 2023

Dear Friend,

I haven’t written in a couple of weeks since I didn’t like the available credit for the spread trade last week. So, how’d you do in the meantime?

Did you collect a 25% profit on Wynn Resorts (WYNN), which expired worthless on Sept. 29?

How about the 26% gain on Intuit (INTU), which expired last Friday?

Are you in any of our open trades? There are seven open right now … and five are profitable, while one is breakeven.

By the way, seven of the past eight closed trades have been max winners, averaging gains of 28% apiece.

I sure hope you’re taking advantage of these free trades.

Unfortunately, because these trades come at least a day after my Terry’s Tips subscribers get them in our weekly Saturday Report, you may not be getting as good a price at trade entry. Of course, you’re still doing well … assuming you’ve been making these trades.

That’s why I want to remind you that the only way to get these trades earlier is to become a Terry’s Tips (TT) premium subscriber. But getting these trades earlier is only a small benefit of being a TT member.

Our four TT portfolios continue to outperform the S&P 500. In fact, we gained about 1.5% in Monday’s trading alone. Our QQQ portfolio had a great week last week and is now up more than 70% for the year, while our MSFT portfolio is up around 30%.

How long can you afford to miss out on these profits? For our loyal newsletter subscribers (that’s you), I’m of course keeping the sale going that saves you more than 50% on a monthly subscription to Terry's Tips.

You’ll get …

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions. Trade one portfolio or all four. It’s up to you.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week's trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

To become a Terry's Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, keep all the valuable reports.

I look forward to having you join in the fun and profits! Now on to the trade ...

You’re in luck with this week’s trade because the entry price didn’t move a penny on Monday. It’s another bearish position on a company that owns a bunch of well-known restaurants. You should be able to get close to the entry price if you jump on it Tuesday morning.

Good luck with the trade!

Where’s the Beef?

With earnings reports virtually dried up this week and wanting to stay on the bearish side, I had to go back a few weeks to find reports that failed to impress the Street. One name that popped up was a stock that we successfully played (28% profit) for a bullish winner back in March - Darden Restaurants (DRI), the sit-down restaurant chain conglomerate that includes Olive Garden, LongHorn Steakhouse, Capital Grille, and the recently acquired Ruth’s Chris Steak House.

DRI reported earnings a couple of weeks ago. The numbers were solid, as the company beat estimates on both the top and bottom lines. Same-restaurant sales also handily beat expectations. Moreover, sales and profits were higher than a year earlier. The only negatives were slowing growth in its fine-dining holdings and some concern over its aggressive expansion plans amid a potential recessionary environment.

Analysts seemed unmoved by the seemingly positive news. The report was met with a mix of target price upgrades and more numerous downgrades. This left the average target in the $160-170 range, well above Friday’s $137 close. With no ratings changes, analysts remain firmly in the buy/outperform camp.

Perhaps analysts should take closer note of DRI’s stock chart and post-earnings performance. After hitting an all-time high in late July, the stock is down 21% and logged its lowest close in nearly a year on Friday. I’ll point out that the S&P 500 is down just 5% over the same time frame. This slump has been perfectly guided by the 20-day moving average, a trendline the stock hasn’t closed above in more than two months. Also, for technical wonks, the 50-day moving average is crossing below the 200-day moving average, also known as the “death cross.”

This bearish trade is based on the stock’s continued slump even after the good earnings results. With analysts perhaps too optimistic, it’s reasonable to expect some target price reductions, if not some ratings downgrades that could further pressure the share price.

Finally, the 20-day resistance is hard to ignore, which is why we’re playing a call spread with the short call strike sitting just above this trendline. Note that this trade has a smaller return than most because I wanted the short strike to be above the 20-day. Thus, we have a larger cushion of safety and greater probability of profit.

If you agree that the stock will continue its downtrend based on the resistance from its 20-day moving average (blue line), consider the following credit spread trade that relies on DRI staying below $145 (red line) through expiration in 6 weeks:

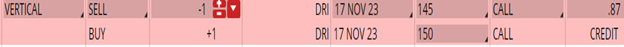

Buy to Open the DRI 17 Nov 150 call (DRI231117C150)

Sell to Open the DRI 17 Nov 145 call (DRI231117C145) for a credit of $0.85 (selling a vertical)

This credit is $0.02 less than the mid-point price of the spread at Friday’s $136.94 close. Unless DRI falls sharply at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $83.70. This trade reduces your buying power by $500, making your net investment $416.30 per spread ($500 - $83.70). If DRI closes below $145 on Nov. 17, the options will expire worthless and your return on the spread would be 20% ($83.70/$416.30).

Testimonial of the Week

It is often said that options are to stock trading as chess is to checkers. I was looking to find the chess master amongst the checker’s champs, and Terry is the one. Looking for very smart yet understandable way to trade options? Look no further. ~ Phil Wells

Remember to click here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off.

Any questions? Email Jon@terrystips.com.

Thank you again for being a part of the Terry's Tips newsletter.

Happy trading,

Jon L