Subject: Option Trade of the Week – We Want Profits, NOW!

August 1, 2023

Dear Friend,

Holy Cow!! Our 10k Strategy is on fire!

Terry’s Tips subscribers just had their best week in more than 3 years! And leading the parade was our Microsoft (MSFT) portfolio, which gained 40% - that is not a typo - even though the stock dropped after earnings.

Meanwhile, our QQQ portfolio kept on chugging and is now up more than 85% for the year.

The gains we collected on MSFT … in just one week … more than paid for a year’s subscription to Terry’s Tips. And our QQQ profits this year have paid for a subscription for the next seven years.

What are you waiting for? You need to get in on the action by leveraging the power of the 10k Strategy now.

Don’t miss out on the profits. For our loyal newsletter subscribers, I’m of course keeping the sale going that saves you more than 50% on a monthly subscription to Terry's Tips.

You’ll get …

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week's trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

To become a Terry's Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, keep all the valuable reports.

I look forward to having you join in the fun and profits! Now on to the trade ...

******

Here's your Option Trade of the Week as included in this past weekend’s Saturday Report for our Terry’s Tips Insider Members. We’re on to another bullish post-earnings trade that has started off well. And even though the credit is less than that available this morning, I still like the trade’s risk/reward. So, make sure to jump on it Tuesday morning.

Good luck with the trade!

We Want Profits, NOW!

With earnings season now at its peak, there were plenty of opportunities this week. I wanted to return to the bullish side with a stock that posted solid results that were not reflected in the price action. The best candidate I found was cloud platform provider ServiceNow (NOW). NOW reported after the bell on Wednesday, and there was nothing to complain about. Earnings and revenue were up sharply, and both beat estimates. The company raised its quarterly and full-year subscription revenue forecasts above the Street consensus. Moreover, NOW unveiled two major additions to its suite of AI software.

Analysts were clearly impressed with the news, as there was a flurry of target price increases. Despite these raises, the consensus target price is only 5-10% above Friday’s close, which is not much for a tech name. There were no ratings upgrades, probably because most analysts are already in the “buy” camp.

Despite the impressive results and news, the stock slumped on Thursday, falling 3%. That pulled the stock down to the support of its 50-day moving average, a trendline NOW last closed below in early May. The 50-day has guided the stock higher throughout 2023, helping it to a 47% gain for the year. This trade is based on the 50-day support holding through the next several weeks. Accordingly, the short put strike of our credit spread sits just below the trendline.

If you agree that the stock will continue to respect its trendline support (blue line), consider the following credit spread trade that relies on NOW staying above $550 (red line) through expiration in 6 weeks:

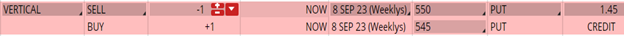

Buy to Open the NOW 8 Sep 545 put (NOW230908P545)

Sell to Open the NOW 8 Sep 550 put (NOW230908P550) for a credit of $1.40 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $569.54 close. Unless NOW surges at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $138.70. This trade reduces your buying power by $500, making your net investment $361.30 per spread ($500 - $138.70). If NOW closes above $550 on Sep. 8, the options will expire worthless and your return on the spread would be 38% ($138.70/$361.30).

Testimonial of the Week

I’ve been involved with investing equities, options and futures for most of my life and I’m seventy years old. You are to be congratulated on your method, expertise and diligence. I plan to add to my account and the number of portfolios. ~ Karl

Any questions? Email Jon@terrystips.com. And remember, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off.

Thank you again for being a part of the Terry's Tips newsletter.

Happy trading,

Jon