Subject: Option Trade of the Week – This Stock is No Stretch

September 5, 2023

Dear Friend,

Finally.

I’ve waited a month to send out one of these letters with a trade that you can reasonably enter. The past three have run away from our entry price so quickly that there was not nearly enough credit to make the trades worthwhile.

It bears repeating … I refuse to send you a worthless trade just to throw some marketing out. That’s the surest way for you to look elsewhere for trading ideas. If I like the trade, I’ll send it. If I don’t - like the past three on Wynn Resorts (WYNN), Estee Lauder (EL) and Intuit (INTU) – you won’t see an email from me.

Today, however, we have one that didn’t move much today. Tonight’s closing price was a couple of pennies away from the trade price, so there’s a good chance you can enter tomorrow.

But first, I have to tell you that … wait for it … our portfolios have hit a little rough patch of late. That’s right, we’re down since I last sent a trade out. I won’t go into the weeds about why (my subscribers got an earful on that subject) other than to say, “that’s trading.” You can’t go up all the time.

But here’s the thing … I’m not afraid to say it. I’ll own it. It’s happened before and it’ll happen again. When it does, we take the hit and move on.

We’re still beating the pants off the S&P. Our QQQ and MSFT portfolios are up 75% and 46% for the year, respectively. We’ll be fine.

So are you willing to “buy the dip?” Are you ready to leverage the power of the 10k Strategy now?

You can’t afford to miss out on these profits. For our loyal newsletter subscribers, I’m of course keeping the sale going that saves you more than 50% on a monthly subscription to Terry's Tips.

You’ll get …

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week's trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

To become a Terry's Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, keep all the valuable reports.

I look forward to having you join in the fun and profits! Now on to the trade ...

This Stock is No Stretch

With the market throwing off bullish vibes this week, we’re going with another bullish trade on one of the few notable names that reported earnings this week: athletic apparel maker Lululemon Athletica (LULU). The company reported solid numbers after the bell on Thursday, including an 18% revenue jump that surpassed the analyst estimate. Earnings also handily beat expectations. To complete the trifecta, full-year revenue and earnings guidance came in above the analyst estimate.

Analysts were seemingly thrilled with the numbers, as a slew of price target increases poured in. But many raised the price by only a few dollars, which is meaningless for a $400 stock. After the flurry, the new average target price stands only around 3% above Friday’s close. And there were no ratings changes, leaving the current consensus in the buy/outperform category.

So, while analysts appear bullish, nobody seems willing to bet the mortgage payment on LULU. I’m fine with that, however, as I hesitate to jump on a bandwagon that’s already full. I like to see some room for upgrades and target price increases.

Traders apparently thought differently, pushing LULU up 6% on Friday to an 18-month high. It also propelled the stock above a trading range that has captured most of the price moves of the past five months. Note in the chart how the 20-day and 50-day moving averages have combined forces near the 380 level. I expect these trendlines to rise above the top of the range around $385 within the next week or two. That should provide a multi-layered tier of support to keep the short put of our spread out of the money.

The other technical driver of this trade is the fact that LULU tends to stay flat for several weeks after earnings. That is, the stock doesn’t tend to stray too far from its initial post-earnings move. Given that we have around a 5% cushion combined with the trading range and potential trendline support, I like the odds of LULU staying above the key $385 mark through expiration.

If you agree that the stock will respect the top of its trading range, consider the following credit spread trade that relies on LULU staying above $385 (green line) through expiration in 6 weeks:

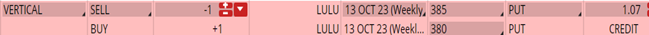

Buy to Open the LULU 13 Oct 380 put (LULU231013P380)

Sell to Open the LULU 13 Oct 385 put (LULU231013P385) for a credit of $1.05 (selling a vertical)

This credit is $0.02 less than the mid-point price of the spread at Friday’s $404.19 close. Unless LULU surges at the open on Tuesday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $103.70. This trade reduces your buying power by $500, making your net investment $396.30 per spread ($500 - $103.70). If LULU closes above $385 on Oct. 13, the options will expire worthless and your return on the spread would be 26% ($103.70/$396.30).

Testimonial of the Week

I have been a subscriber for about a year. I autotrade in 2 different accounts, all your strategies. I read everything you write on Saturdays. I love your happiness thoughts and everything else. I usually do not communicate at all but I had to tell you how well my accounts with you are doing compared to everything else. You are awesome. Keep up the good work. Thank you. - Maya

Any questions? Email Support@terrystips.com. And remember to click here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off.

Thank you again for being a part of the Terry's Tips newsletter.

Happy trading,

Jon