Subject: Option Trade of the Week – Room to Run

August 7, 2023

Dear Friend,

The profit beat continues. After our best week in more than 3 years, Terry’s Tips subscribers had another great week. Our QQQ portfolio is now up more than 94% for the year, while our MSFT portfolio has a 43% profit.

Not only that, all our portfolios combined are outperforming the S&P 500 by a 2 to 1 margin. We’re doubling up the S&P, which is having a solid year itself.

You can’t afford to miss out on these profits. For our loyal newsletter subscribers, I’m of course keeping the sale going that saves you more than 50% on a monthly subscription to Terry's Tips.

You’ll get …

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week's trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

To become a Terry's Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, keep all the valuable reports.

I look forward to having you join in the fun and profits! Now on to the trade ...

Here's your Option Trade of the Week as included in this past weekend’s Saturday Report for our Terry’s Tips Insider Members. We’re going with another bullish post-earnings trade that has started off well. And even though the credit is less than that available this morning, I still like the trade’s risk/reward. So, make sure to jump on it Tuesday morning.

Good luck with the trade!

Room to Run

Although this was the busiest week of earnings season – loaded with big tech names – we’re going to wade into calmer waters with Marriott International (MAR). The company runs the gamut of hotel offerings, operating under 30 brand names in 138 countries. The company reported on Tuesday before the open, beating estimates on both revenue and earnings. The hotelier also raised its Q3 and FY 23 earnings projections, which also are above expectations. MAR’s CFO noted that domestic travel demand continues to grow while international markets are starting to heat up. Business and group travel is also improving.

Analysts were less than ebullient toward the news, however. While the stock received several target price increases, there were no ratings changes. In fact, MAR’s average analyst rating sits between a buy and hold. The average target price ranges from $203 (right on its current price) down to $177, depending on the data source. And this is after the target increases. Either way, this is at best a sluggish endorsement of the stock, which is consistent with the ratings.

In contrast, MAR’s chart tells a more bullish story. The stock traded slightly higher after earnings through Friday amid a lower market. But the shares are up 36% in 2023, putting it on par with MSFT. Since late June, MAR has been on a solid rally covering 19% that included an all-time high on Wednesday. Currently, the stock has been trading well above its 20-day moving average, a trendline the stock has stayed close to throughout the runup. Note that the short strike of our put spread is at 195, a mark the 20-day just moved through.

This trade is based on MAR’s positive outlook, support from the 20-day moving average and analysts (hopefully) realizing that they have been too cautious toward the stock. MAR’s performance this year deserves better than what analysts have grudgingly offered.

If you agree that the stock will continue to respect its trendline support (blue line), consider the following credit spread trade that relies on MAR staying above $195 (red line) through expiration in 6 weeks:

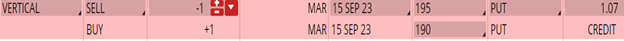

Buy to Open the MAR 15 Sep 190 put (MAR230915P190)

Sell to Open the MAR 15 Sep 195 put (MAR230915P195) for a credit of $1.05 (selling a vertical)

This credit is $0.02 less than the mid-point price of the spread at Friday’s $202.98 close. Unless MAR surges at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $103.70. This trade reduces your buying power by $500, making your net investment $396.30 per spread ($500 - $103.70). If MAR closes above $195 on Sep. 15, the options will expire worthless and your return on the spread would be 26% ($103.70/$396.30).

Testimonial of the Week

I can’t figure out why everyone isn’t using calendar spreads using your method. Sometimes it seems too good to be true. My returns the past two years have been almost unbelievable. I don’t even try to tell anyone about it because they wouldn’t believe me. ~ Fred

Remember to click here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off.

Any questions? Email Jon@terrystips.com. Thank you again for being a part of the Terry's Tips newsletter.

Happy trading,

Jon