Subject: Option Trade of the Week - No Do-Over for Earnings

February 15, 2023

Dear Friend,

Here is your Option Trade of the Week, as given to our Terry’s Tips Insider Members as part of their Saturday Report. It’s another post-earnings trade, this time on the bearish side. And you can now collect even more premium for this trade than when I first sent it out.

Before getting to the trade, it’s time for another plug to join Terry's Tips as an Insider Member that lets you trade up to four portfolios. These portfolios use our proprietary 10K Strategy, which has generated average annual gains of 60% for the past five years in actual brokerage accounts (including all commissions). In 2022, our portfolios beat their underlying stock performance by an average of 22%.

And we’re off to a great start in 2023 … in fact, our portfolio based on IWM, the popular small-cap ETF, is up nearly 14% year to date.

For our loyal newsletter subscribers, I’ve decided to keep the sale going that saves you more than 50% on a monthly subscription to Terry's Tips. For just $98, you'll get:

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week's trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

To become a Terry's Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, still keep all the valuable reports.

We look forward to having you join us! Now on to the trade ...

No Do-Over for Earnings

Take-Two Interactive Software (TTWO) – the developer of popular video games such as Grand Theft Auto and Red Dead Redemption – reported earnings this week that were not fun and games. The company fell short of expectations for earnings and revenue (more specifically, net bookings), citing gamers being more careful with their spending. To add more misery, TTWO lowered its revenue guidance for the fourth quarter and FY 2023. The company also announced cost-cutting measures, including dropping personnel.

Analysts were mostly disappointed in the report, responding with a series of lowered target prices (there was one increase). The new average target is still 17% above Friday’s closing price, so there’s room for more cuts. There were no rating changes, which seems at odds with the price moves. Given that 80% of covering analysts rate the stock a buy or better, you’d think there could be some downgrades based on earnings that could put pressure on the shares.

Despite the poor report, TTWO surged nearly 8% the day after earnings. But that brought the stock close to its declining 200-day moving average, a trendline it last traded above exactly one year ago. Moreover, it’s noteworthy that the shares sagged throughout the rest of the week following the earnings pop. This trade is thus based on the 200-day resistance holding over the next several weeks, as we are playing a call spread with the short call strike sitting above the trendline.

If you agree that TTWO will continue to struggle under the weight of the 200-day moving average (blue line), consider the following trade that relies on the stock staying below $117 (red line) through expiration in 7 weeks:

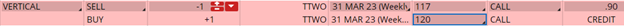

Buy to Open the TTWO 31 Mar 120 call (TTWO230331C120)

Sell to Open the TTWO 31 Mar 117 call (TTWO230331C117) for a credit of $0.85 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $111.10 close. Unless TTWO falls quickly, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $83.70. This trade reduces your buying power by $300, making your net investment $216.30 per spread ($300 - $83.70). If TTWO closes below $117 on Mar. 31, both options will expire worthless and your return on the spread would be 39% ($83.70/$216.30).

Any questions? Email Terry@terrystips.com. Thank you again for being a part of the Terry's Tips newsletter.

Happy trading,

Jon