Subject: Option Trade of the Week – Health Bear … Sort Of

September 12, 2023

Dear Friend,

No marketing this week ... you deserve a week off. Let's get to the trade ...

Here is your Option Trade of the Week, as given to our Terry’s Tips Insider Members as part of the Saturday Report. With no earnings reports to play with, I'm going with an ETF that hasn't done a whole lot lately. To make the trade more attractive, the credit went up slightly today (for a change), so you should be able to enter tomorrow at a decent price.

Good luck with the trade ...

Health Bear ... Sort Of

With no notable earnings reports this week, we’re turning to an ETF that’s done little of late. It’s the SPDR Health Care ETF (XLV), which holds such heavyweights as UnitedHealth Group (UNH), Eli Lilly (LLY), Merck (MRK), Johnson & Johnson (JNJ) and Amgen (AMGN) among its top 10 holdings. This trade is a bearish credit spread, though I’m not particularly bearish on the sector. I’m not bullish, either. But that’s the beauty of credit spreads. You can be more neutral than directional and still collect a maximum profit so long as the short strike remains out of the money. It’s a forgiving strategy that caters to those who don’t have a strong directional bias.

I’m using a bearish call spread for this trade because the overhead 135 level has proven difficult for XLV to overcome throughout most of 2023. In fact, the ETF has closed above this mark only a handful of times since January. Recent attempts to take out 135 were rejected in April, August and July.

Although XLV currently sits below all its major moving averages, it hasn’t respected these trendlines for support or resistance for much of the year. So, even though the 20-day, 50-day and 200-day moving averages lie between the current XLV price and the 135 level, I’m not relying on their potential for resistance. This is more about the 135 level acting as a top in recent months.

Note that this trade extends into the start of the next earnings season. In fact, four of XLV’s top 10 holdings, including UNH and JNJ, report before the spread expires on Oct. 20. However, given XLV’s performance this year (down around 3%) and the fact that it’s gone nowhere for seven months, I’m not expecting earnings from a few XLV names to give the ETF a huge shot in the arm prior to expiration.

If you agree that XLV will continue its “meh” performance, consider the following credit spread trade that relies on XLV staying below $135 (blue line) through expiration in 6 weeks:

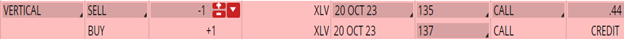

Buy to Open the XLV 20 Oct 137 call (XLV231020C137)

Sell to Open the XLV 20 Oct 135 call (XLV231020C135) for a credit of $0.40 (selling a vertical)

This credit is $0.04 less than the mid-point price of the spread at Friday’s $132.06 close. Unless XLV sinks sharply at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $38.70. This trade reduces your buying power by $200, making your net investment $161.30 per spread ($200 - $38.70). If XLV closes below $135 on Oct. 20, the options will expire worthless and your return on the spread would be 24% ($38.70/$161.30).

Thank you again for being a part of the Terry's Tips newsletter.

Happy trading,

Jon