Subject: Option Trade of the Week - Fool Me Once ... (VEEV)

April 1, 2024

Dear Friend,

We’re back with another Option Trade of the Week as included in this past weekend’s Saturday Report for our Terry’s Tips Premium Members. This is the first time in a couple of weeks that the spread price looks better now than it did last week, so I wanted to get it in your hands quickly.

But first … we had a monster first quarter in our Terry’s Tips portfolios. Our Microsoft (MSFT) portfolio gained more than 15%, while our IWM portfolio was up just shy of 20%. But our big winner was Costco (COST), which soared more than 30%.

Those gains would be impressive for a whole year … but we did it in just one quarter!

And no, this is not an April Fool's joke. These profits are real.

How are we doing it? The same way we bagged 70% and 92% profits using MSFT and QQQ last year – Dr. Terry Allen’s 10K Strategy. This market-beating strategy has proven itself over the past two decades … and this year looks to be no exception.

You can’t afford to miss out on these profits. Resolve to make 2024 your best trading year ever – and learn about Terry’s unique strategy – by becoming a Premium Member of Terry’s Tips. For our loyal newsletter subscribers (that’s you), I’m of course keeping the sale going that saves you more than 50% on a monthly subscription to Terry's Tips. Plus, I’m adding a promise that this rate will never increase. I won’t make this promise forever, though, so now is the time to get in on the action … and profits.

As a Premium Member to Terry’s Tips, you’ll get …

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions. Trade one portfolio (I recommend Wiley Wolf) or all four. It’s up to you.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week's trading activity and early access to our Option Trade of the Week.

- Follow-up discussion on managing our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

- Annual subscription available for more than 50% savings

And, for a limited time, I am including a Special Bonus. Terry Allen has condensed his 30 years of options trading experience into an eBook – Making 36% - A Duffer’s Guide to Breaking Par in the Market Every Year, in Good Years and Bad. Learn a different way to trade using Terry’s unique and decades-tested 10K Strategy. This book is normally $9.98 on our website (and $19.95 on Amazon), but I will personally send you the digital version for free with a paid subscription.

To become a Terry's Tips Premium Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, keep all the valuable reports and the book.

I look forward to having you join in the fun and profits! Now on to the trade ...

Fool Me Once ...

There was nothing on the weekly earnings docket that I considered trade worthy. Even the few names I recognized were either too low-priced, had lousy options or bid/ask spreads, or, most importantly, not giving me a good chart read. During slow earnings periods – which include next week and most of the following week – I look back at past trades to see how they look today. One that I like just happens to be the last trade we closed for a loss. But I whiffed so badly on it – I suggested a bearish trade and the stock cruised 20% higher - that I now like it as a bullish play.

The stock is Veeva Systems (VEEV), which provides cloud-based software for the health sciences industry. VEEV reported solid earnings results in late February, beating estimates on revenue and earnings per share. Guidance for the first quarter came up short on revenue, which may be why the stock stumbled a bit after the report.

Analysts were very clear in their view toward VEEV, handing the stock a boatload of target price increases. Maybe they’re trying to play catch-up because the current average target price – after all the increases – is right around Thursday’s closing price. Given that VEEV is a tech stock (though it’s considered in the healthcare sector), that’s an underwhelming endorsement for a stock that’s rallied 40% in less than four months. It’s not hard to see how more target price increases and perhaps a ratings change or two (the current average rating is a buy) could be in the offing.

There aren’t many charts prettier than VEEV’s daily chart. The stock has climbed steadily since an early December low, riding along the solid support of its 20-day moving average. How solid? The trendline has been tested no less than a half-dozen times and has allowed just one daily close below it. This trade is based on the uptrend and support continuing for the next several weeks, perhaps aided by some analyst love.

The 20-day moving average sits just below the 230 level, while the 50-day is at 220. VEEV offers only monthly options, with strikes every 10 points within the range we want. Therefore, I am forced to go with the May series and the 220 short strike. This is producing a little less credit – and thus return – compared to our usual trades. But that means the short strike is further out of the money (less risky).

If you agree that the stock will continue to trade above its 20-day (blue line) moving average, consider the following credit spread trade that relies on VEEV staying above $220 (red line) through expiration in 7 weeks:

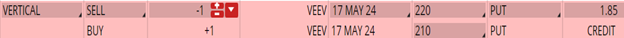

Buy to Open the VEEV 17 May 210 put (VEEV240517P210)

Sell to Open the VEEV 17 May 220 put (VEEV240517P220) for a credit of $1.80 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $231.69 close. Unless VEEV surges at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $178.70. This trade reduces your buying power by $1,000, making your net investment $821.30 per spread ($1,000 - $178.70). If VEEV closes above $220 on May 17, the options will expire worthless and your return on the spread would be 22% ($178.70/$821.30).

Testimonial of the Week

It is often said that options are to stock trading as chess is to checkers. I was looking to find the chess master amongst the checker’s champs, and Terry is the one. Looking for very smart yet understandable way to trade options? Look no further.

~ Phil W

Remember to click here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. And get Terry’s eBook for free.

Any questions? Email Jon@terrystips.com. Thank you again for being a part of the Terry's Tips newsletter.

Happy trading,

Jon L