Subject: Option Trade of the Week - Feeling Chipper

February 1, 2023

Dear Friend,

Here is your Option Trade of the Week, as given to our Terry’s Tips Insider Members as part of the Saturday Report. With earnings season in full swing, we had lots to choose from this week. We’re back in the chip sector with a bullish play.

Before getting to the trade, there’s still time to jump on our huge discount offer to join Terry's Tips as an Insider Member that lets you trade up to four portfolios. These portfolios use our proprietary 10K Strategy, which has generated average annual gains of 60% for the past five years in actual brokerage accounts (including all commissions). In 2022, our portfolios beat their underlying stock performance by an average of 22%.

We're still running a special new-year sale that saves you more than 50% on a monthly subscription to Terry's Tips. For just $98, you'll get:

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week's trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

To become a Terry's Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, still keep all the valuable reports.

We look forward to having you join us in 2023! Now on to the trade ...

Feeling Chipper

KLA Corp. (KLAC) provides process-control technology to the semiconductor industry. The company reported earnings after the bell on Thursday that beat estimates on both the top and bottom lines. But the fly in the ointment came in the form of a lowered outlook for the third quarter that fell below expectations. The stock fell nearly 7% on Friday, its largest one-day, post-earnings decline in eight years.

So, why the optimism? First, analysts didn’t seem all that concerned. While there was one downgrade on the news, the stock was hit with several target price increases. The current average price target for KLAC is only about 8% above Friday’s close. That’s far from unreasonable given how analysts usually are more ebullient toward tech names. And the average analyst rating is a moderate buy, which leaves room for future upgrades.

Second, KLAC’s chart shows that Friday’s plunge, while perhaps unsettling, did not signal the end of the stock’s current strong rally. Even with the Friday drop, the stock has gained 60% in just three months. The rally has been guided by the combined support of the 20-day and 50-day moving averages. The 50-day is the key to this trade, however, as it has not allowed a daily close below it since early November. It also served as key support during a pullback in late December. Note that the short strike of our put spread is below the 50-day, so the stock will have to pierce this support to move the spread into the money.

Third, while the early returns on chip stocks (including Intel this week) suggest some rougher waters next quarter, the sector as a whole is rallying. The VanEck Semiconductor ETF (SMH) has been on a strong, month-long rally and hit a five-month high during Friday’s session.

If you agree that KLAC will continue to find support at its 50-day moving average (blue line), consider the following trade that relies on the stock staying above $390 (red line) through expiration in 6 weeks:

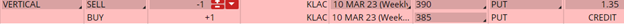

Buy to Open the KLAC 10 Mar 385 put (KLAC230310P385)

Sell to Open the KLAC 10 Mar 390 put (KLAC230310P390) for a credit of $1.30 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $399.37 close. Unless KLAC rises quickly, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $128.70. This trade reduces your buying power by $500, making your net investment $371.30 per spread ($500 - $128.70). If KLAC closes above $390 on Mar. 10, both options will expire worthless and your return on the spread would be 35% ($128.70/$371.30).

Testimonial of the Week

I have been a subscriber for about a year. I autotrade in 2 different accounts, all your strategies. I read everything you write on Saturdays. I love your happiness thoughts and everything else. I usually do not communicate at all but I had to tell you how well my accounts with you are doing compared to everything else. You are awesome. Keep up the good work. Thank you.

~ Maya

Thank you again for being a part of the Terry's Tips newsletter. Any questions? Email Terry@terrystips.com

Happy trading,

Jon