Subject: Option Trade of the Week – Cry Me a Rivian

March 7, 2023

Dear Friend,

Here is your Option Trade of the Week, as given to our Terry’s Tips Insider Members as part of their Saturday Report. I again stayed on the bearish side this week, as this market is looking very vulnerable, especially after today’s Congressional testimony from Jerome Powell.

However, as I did a couple of weeks ago, I’m revising the trade because the position has run away from the opening price. Because of a huge plunge in the stock price today, the trade is already up nearly 20% in just two days. Because I still believe in the premise of the trade, I’m changing the strikes to give you a similar entry credit … and, of course, profit. Good luck with it.

Before getting to the trade, I wanted to let you know that the Terry's Tips portfolios are on a hot streak. The combined four portfolios are now beating the S&P 500, led by the Boomer's Revenge portfolio, which is up a whopping 18% so far this year! That’s on top of the 33% gain during last year’s horrible market performance. Overall, our portfolios beat their underlying stock performance by an average of 22% in 2022.

Don’t get left behind. For our loyal newsletter subscribers, I’ve decided to keep the sale going that saves you more than 50% on a monthly subscription to Terry's Tips. For just $98, you'll get:

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week's trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

To become a Terry's Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, still keep all the valuable reports.

We look forward to having you join us! Now on to the trade ...

Cry Me a Rivian

Electric car maker Rivian (RIVN) reported earnings on Tuesday after the bell that were mixed at best. The company narrowed its adjusted Q4 loss to beat the consensus estimate but missed considerably on revenue. Of greater importance, however, is RIVN’s expected 2023 production of 50,000 compared to the expected 60,000 units.

But on Friday, word “leaked” of a 62,000-unit goal discussed at an internal company meeting. The shares reacted with a 7.6% surge, but still closed the week lower. Although nobody knows for sure, this looks to me like a classic “buy the rumor, sell the news” scenario.

What is known, however, is that the stock was hit with a number of lowered price targets on the earnings news. Yet even with the reductions, the average target price is nearly double Friday’s close. That’s awfully optimistic for a stock that is down 70% from its 52-week high and 8% so far this year. Moreover, the EV space is getting more crowded, even as the dominant player – Tesla – is enjoying a resurgence.

On the chart, RIVN is trading toward the bottom of a two-month range that is being pressured by the declining 20-day (red line) and 50-day (blue line) moving averages. The short call strike of our bearish credit spread sits above these trendlines, so the stock will have to break through this double-barrelled resistance to move the spread into the money.

If you agree that RIVN will struggle with technical resistance following an uninspiring earnings report, consider the following trade that relies on the stock staying below $19 (green line) through expiration in 6 weeks:

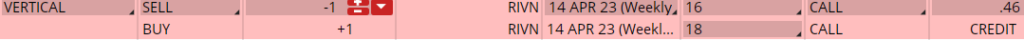

Buy to Open the RIVN 14 Apr 18 call (RIVN230414C18)

Sell to Open the RIVN 14 Apr 16 call (RIVN230414C16) for a credit of $0.45 (selling a vertical)

This credit is $0.01 less than the mid-point price of the spread at Tuesday’s $14.64 close. Unless RIVN falls quickly, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $43.70. This trade reduces your buying power by $200, making your net investment $156.30 per spread ($200 - $43.70). If RIVN closes below $16 on Apr. 14, both options will expire worthless and your return on the spread would be 28% ($43.70/$156.30).

Testimonial of the Week

I have been a subscriber for about a year. I autotrade in 2 different accounts, all your strategies. I read everything you write on Saturdays. I love your happiness thoughts and everything else. I usually do not communicate at all but I had to tell you how well my accounts with you are doing compared to everything else. You are awesome. Keep up the good work. Thank you. - Maya

Any questions? Email Terry@terrystips.com. Thank you again for being a part of the Terry's Tips newsletter.

Happy trading,

Jon