Subject: Option Trade of the Week - Cold and Soggy

September 25, 2023

Dear Friend,

I skipped last week because I didn’t like the available credit for the spread trade I had sent over the weekend. As you know, if I don’t like the risk/reward, I don’t send the trade.

This week is different, though. It’s a post-earnings trade on a well-known brand name that has around the same credit as when I sent it to my Saturday Report subscribers. I’m guessing you should be able to get near my entry price on Tuesday.

Before I get to the trade, just a reminder that our Terry’s Tips portfolios continue to beat the market. Stocks are having a rough September, and October is setting up to be a sketchy month as well. But we’re well positioned to leverage the recent increase in volatility no matter which way the market goes.

You can’t afford to miss out on these profits. For our loyal newsletter subscribers, I’m of course keeping the sale going that saves you more than 50% on a monthly subscription to Terry's Tips.

You’ll get …

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions. Trade one portfolio or all four. It’s up to you.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week's trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

To become a Terry's Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, keep all the valuable reports.

I look forward to having you join in the fun and profits! Now on to the trade ...

Cold and Soggy

There were a few interesting earnings announcements this week, even though we’re in the quiet period for earnings reports (things start to ramp up again in three weeks). In fact, I had three bearish plays to choose from. That’s a good thing since we currently have three bullish and three bearish trades open, and I feel like the bears need a little more weight after the past week’s Fed-infected price action.

The trade this week is on prepared-food giant General Mills (GIS), which owns several iconic cereal brands along with such names as Betty Crocker, Blue Buffalo, Pillsbury, Progresso, Green Giant and Yoplait. GIS reported earnings numbers on Wednesday before the open that were filled with a lot of “buts.” Sales increased 4% due to higher prices, but volume was lower. Net income beat the consensus expectation but fell 18% from a year ago. GIS executives are bullish on their pet food segment but sales for the quarter were flat. Moreover, some analysts feel that consumers are reaching their limit on rising food costs. And GIS’s CFO said that the company’s operating profit margin will not improve this year.

All in all, it was not a great report, which is perhaps why the stock was hit with a few price target cuts. At least there were no ratings downgrades. Analysts on the whole are neutral toward the stock, while the average target price is in the $70-75 range compared to Friday’s close near $65.

Perhaps analysts would be a bit more skeptical if they took a quick glance at GIS’s chart, which shows the stock plunging 30% in the past four months. This descent has been expertly guided by the 20-day moving average, a trendline the stock has closed above just four times since mid-May. This resistance was evident the two days after earnings this week, when the shares failed to pierce the 20-day with early rallies. Note that the short call strike of our spread sits above this trendline.

If you agree that the stock will continue its downtrend after an uninspiring earnings report and remain below its 20-day moving average (blue line), consider the following credit spread trade that relies on GIS staying below $67.50 (red line) through expiration in 8 weeks:

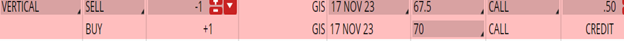

Buy to Open the GIS 17 Nov 70 call (GIS231117C70)

Sell to Open the GIS 17 Nov 67.5 call (GIS231117C67.5) for a credit of $0.45 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $64.82 close. Unless GIS falls sharply at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $43.70. This trade reduces your buying power by $200, making your net investment $156.30 per spread ($200 - $43.70). If GIS closes below $67.50 on Nov. 17, the options will expire worthless and your return on the spread would be 28% ($43.70/$156.30).

Testimonial of the Week

It is often said that options are to stock trading as chess is to checkers. I was looking to find the chess master amongst the checker’s champs, and Terry is the one. Looking for very smart yet understandable way to trade options? Look no further.

~ Phil Wells

Any questions? Email Jon@terrystips.com.

Thank you again for being a part of the Terry's Tips newsletter.

Happy trading,

Jon

**Don't miss out ... you can save more than 50% on a monthly subscription to Terry's Tips. Just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off.**