Subject: Option Trade of the Week – A Gnawing Feeling

June 7, 2023

Dear Friend,

I held off on sending the newsletter this week because our weekly trade ran away from us on Monday. But it has since returned, and you can now enter at a very favorable price. So, here is your Option Trade of the Week, as included in this past weekend’s Saturday Report for our Terry’s Tips Insider Members. This is a post-earnings bearish trade that looks better today than it did over the weekend. Good luck with the trade!

But first, our Honey Badger portfolio is unstoppable. I know I sound like a broken record, but it’s now up more than 50% for 2023. Of course, don’t forget that our portfolios beat their underlying stock performance by an average of 22% in 2022.

Don’t miss out on the profits. For our loyal (thanks for that, by the way) newsletter subscribers, I’m keeping the sale going that saves you more than 50% on a monthly subscription to Terry's Tips.

You’ll get …

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week's trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

To become a Terry's Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, still keep all the valuable reports.

I look forward to having you join in the fun! Now on to the trade ...

A Gnawing Feeling

With earnings season winding down, there are few post-earnings plays to consider. But the cupboard isn’t completely bare. After a couple of bullish trades, we’re going the other way with a bearish play on pet food provider Chewy (CHWY), which reported earnings after the bell on Wednesday. The company easily beat forecasts on earnings and topped revenue expectations. Moreover, CHWY announced it would expand into Canada in 3Q, its first foray outside the U.S. The stock soared on the news, spiking as high as 27% the next day before closing 22% higher.

So why the bearish trade? The number of active customers declined for the second quarter in a row, leading some analysts to question CHWY’s ability to maintain strong sales growth. In addition, competitors have noted lower selling prices and customers trading down to cheaper brands. Analysts had a lukewarm reaction to the earnings blowout, with a few small target price increases. That pushed the average price 27% above Friday’s close, which seems excessive for a stock that’s down 33% from an early-February high.

The stock was unable to follow through on Thursday’s surge, falling back on Friday when the market soared. Sitting overhead is the declining 200-day moving average at 38, a trendline the stock last closed above more than two months ago. With earnings – and the huge pop - now out of the way, we are betting on the stock struggling to overtake the 200-day, which is where the short call strike of our spread resides.

If you agree that CHWY will continue to trade under the weight of its 200-day moving average (blue line), consider the following credit spread trade that relies on the stock staying below 38 (red line) through expiration in 6 weeks:

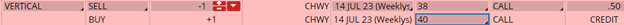

Buy to Open the CHWY 14 Jul 40 call (CHWY230714C40)

Sell to Open the CHWY 14 Jul 38 call (CHWY230714C38) for a credit of $0.47 (selling a vertical)

This credit is $0.03 less than the mid-point price of the spread at Friday’s $35.51 close. Unless CHWY drops sharply at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $45.70. This trade reduces your buying power by $200, making your net investment $154.30 per spread ($200 - $45.70). If CHWY closes below 38 on July 14, both options will expire worthless and your return on the spread would be 30% ($45.70/$154.30).

Testimonial of the Week

It is often said that options are to stock trading as chess is to checkers. I was looking to find the chess master amongst the checker’s champs, and Terry is the one. Looking for the very smart yet understandable way to trade options? Look no further. ~ Phil Wells

Any questions? Email Jon@terrystips.com. Thank you again for being a part of the Terry's Tips newsletter.

Happy trading,

Jon L