Subject: It's Getting Cold in Burlington

September 6, 2022

Dear Friend,

Today we bring you our Option Trade of the Week, an idea generated by our trading team, for your consideration. But first, I would like to remind you that our proprietary 10K Strategy has generated average annual gains of 60% for the past five years in actual brokerage accounts (including all commissions) carried out for our subscribers. In the difficult current year, our portfolios have eked out a 5.5% composite gain while the market indices have fallen by 14%.

You can learn every detail of how to carry out the 10K Strategy on your own for a grand total of $98. In addition, you will get a 14-day options tutorial that will give you a good grasp of the opportunities and dangers of trading options, our latest White Paper, access to several valuable reports, and four weeks of our Saturday Report which shows all the trades and positions of five actual options portfolios. An entire treasure trove of information on stock options. Just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription (and cancel the subscription if you don’t want to continue with the Terry’s Tips newsletter).

It’s Getting Cold in Burlington

Burlington Stores (BURL) reported earnings on August 25 that beat on profits but missed on revenue. Same-store sales fell 17%, more than analysts expected. The reasons should sound familiar by now – consumers coming under increasing price pressures and too much inventory. More significantly, BURL slashed its quarterly and full-year earnings forecast.

Analysts, as usual, are right on with their assessment of the stock. Despite the price being cut in half this year, BURL has an average “buy” rating. I’m not sure what chart they’re looking at. In fact, there are more “buy” and “strong buy” ratings now than in June. Go figure. To their credit, most analysts lowered their price targets for the off-price retailer. But the average target of $176 is still 23% above Friday’s close.

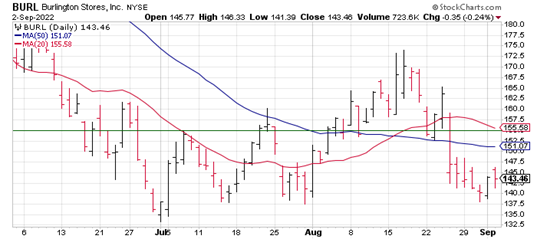

The stock was hammered after the report, dropping 10% to fall below both the 50-day (blue line) and 20-day (red line) moving averages. And it hasn’t recovered since then. We are thus playing a bearish credit spread with the short call (green line) sitting on the 20-day moving average, which is rolling over. Thus, the stock will have to break above two points of resistance to move the spread into the money.

If you agree that BURL will struggle to break through resistance, consider the following trade that relies on the stock staying below $155 through expiration in seven weeks:

Buy to Open the BURL 21Oct 160 call (BURL221021C160)

Sell to Open the BURL 21Oct 155 call (BURL221021C155) for a credit of $1.55 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $143.46 close. Unless BURL falls quickly, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $153.70. This trade reduces your buying power by $500, making your net investment $346.30 per spread ($500 - $153.70). If BURL closes below $155 on October 21, both options will expire worthless and your return on the spread would be 44% ($153.70/$346.30).

Any questions? Email Terry@terrystips.com

Testimonial of the Week

I have been a subscriber for about a year. I autotrade in 2 different accounts, all your strategies. I read everything you write on Saturdays. I love your happiness thoughts and everything else. I usually do not communicate at all but I had to tell you how well my accounts with you are doing compared to everything else. You are awesome. Keep up the good work. Thank you.

~ Maya

Thank you again for being a part of the Terry's Tips newsletter.

Happy trading,

Terry