Subject: Bear Pay

December 27, 2022

Dear Friend,

Today we bring you our Option Trade of the Week, an idea generated by our trading team, for your consideration. After three straight weekly bullish plays, we're heading in the other direction on a stock that reported earnings last week.

Before getting to the trade, I want to remind you that our proprietary 10K Strategy has generated average annual gains of 60% for the past five years in actual brokerage accounts (including all commissions) carried out for our subscribers. In this difficult current year, our portfolios are beating their underlying stock performance by an average of 22%.

And now, we're running a special year-end sale that saves you more than 50% on a monthly subscription to Terry's Tips. For just $98, you'll get:

1) A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions

2) Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week's trading activity and early access to our Option Trade of the Week.

3) Instructions on how to execute the 10K Strategy on your own

4) A 14-day options tutorial on the opportunities and dangers of trading options

5) Our latest White Paper on the 10K Strategy.

6) Full-member access to all our premium special reports that can make you a wiser options trader

To become a Terry's Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but of course still keep all the valuable reports.

We look forward to having you join us in 2023! Now on to the trade ...

Bear Pay

Human resources provider Paychex (PAYX) reported mixed earnings results before Thursday’s open. On the plus side, earnings came in ahead of expectations and the company raised earnings growth guidance for FY2023. But revenue, while meeting the overall target, missed on a segment that analysts consider key for long-term growth.

Whatever the reason, the stock fell after the news, although in fairness, so did the broader market. And it bounced back on Friday along with most stocks to close above its pre-earnings level.

But analysts were not impressed, as the stock was hit with a slew of target price decreases. The average target is now $123.81, a mere 6.7% above Friday’s close. That’s not much compared to the overinflated targets for most stocks. What’s more, the average analyst rating is a hold, which again is well below the view toward most stocks. Perhaps more importantly, at least from my perspective, is that the options market is bearishly pricing out-of-the-money (OTM) puts higher than equally OTM calls.

The stock has performed in line with the broader market throughout 2022, which is to say that it’s down around 20%. It’s off more than 9% from its Dec. 13 high, a move that has caused the 20-day moving average to roll over. The 20-day has done a credible job of guiding rallies and declines throughout 2023, so I view this as a bearish technical indicator. Note that the short strike of our call spread (red line) sits just above the 20-day (blue line), so the stock will have to pierce this trendline resistance to move the spread into the money.

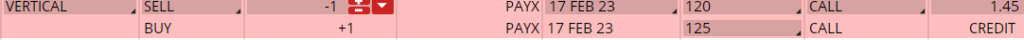

If you agree that PAYX will continue its downtrend, consider the following trade that relies on the stock staying below $120 through expiration in 8 weeks:

Buy to Open the PAYX 17 Feb 125 call (PAYX230217C125)

Sell to Open the PAYX 17 Feb 120 call (PAYX230217C120) for a credit of $1.40 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $116.01 close. Unless PAYX falls quickly, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $138.70. This trade reduces your buying power by $500, making your net investment $361.30 per spread ($500 - $138.70). If PAYX closes below $120 on Feb. 17, both options will expire worthless and your return on the spread would be 38% ($138.70/$361.30).

Testimonial of the Week

I have been a subscriber for about a year. I auto-trade in 2 different accounts, all your strategies. I read everything you write on Saturdays. I love your happiness thoughts and everything else. I usually do not communicate at all but I had to tell you how well my accounts with you are doing compared to everything else. You are awesome. Keep up the good work. Thank you. ~ Maya

Any questions? Email Terry@terrystips.com. Thank you again for being a part of the Terry's Tips newsletter.

Happy trading,

Terry