|

Who needs a swap contract and why?

|

Dear Clients,

Transactions on this derivative, as a rule, are OTC, have no strict

standards (protocol, term,

volume), but they are considered key operations in any market.

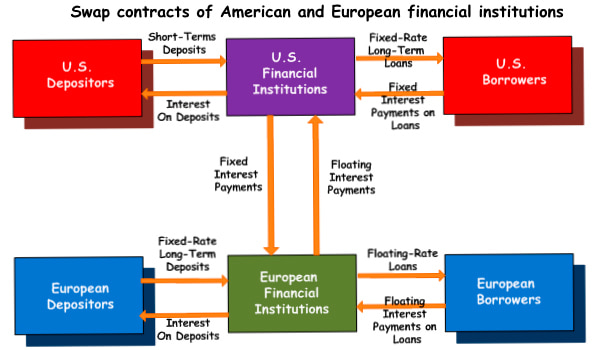

Swap-contract (interest rate, foreign exchange, commodity) a financial

contract under which, at the

same time as the sale of an asset, the parties agree to buy it back at a

fixed price.

Swap-assets have been used as hedging instruments since the early 80s of the

last century. The most

understandable for traders swap-transactions are used on the interbank

market: these are contracts

for interest rates or the exchange of payments at floating and fixed

interest rates. The actual

delivery of the asset is not expected; only the «estimated» difference in

price is exchanged.

Participants in swap-contracts: banks, industrial and financial companies,

investment funds, as well

as private exchange players, who are called «local» in the US, and

«independent traders on the

floor» in France.

|

Main tasks

|

risk hedging;

|

|

optimization of investments and tax payments by terms and/or

profitability;

|

|

loans in different currencies and / or at different interest rates;

|

|

optimization of the liquidity of a company or enterprise;

|

|

transfer of a position in the currency and money markets;

|

|

other «fantasies» of speculators that are constantly evolving.

|

|

|

The swap-contract mechanism is used for secured financing or, conversely,

for the loan of securities

for their delivery under the contract, for example, in case of opening a

short position. Do you

recognize? Yes, these are familiar REPO. Each of the parties can withdraw

from the contract if it

finds a different buyer, although the secondary market for swap operations

is not yet sufficiently

developed. The range of amounts is from $0.5 mln. to $500 mln., but swap

assets become effective

from about $10 mln.

There is no standard scheme, each transaction is individual so that one side

can take advantage of

the capabilities of the other side. Both participants benefit, and the

ability to earn on swap

assets is «cherry on the cake» in the financial market.

|

|

|