|

Real crypto futures and market BTC

|

Dear Clients,

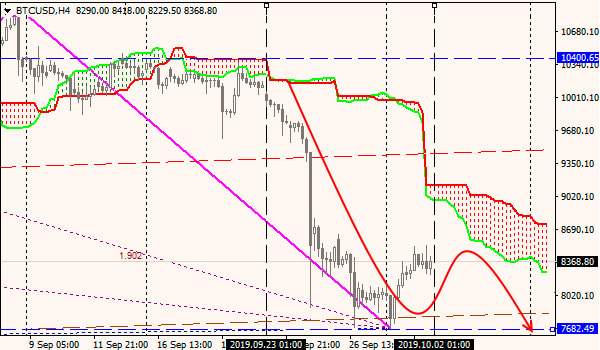

Attempts to explain another failure of BTC prices by more than 20% divided

analysts into two camps.

|

Traditional reason:

Expiry of more than 50% of quarterly BTC futures on CME (09/22/19), the

closing of options on Deribit and LedgerX (09/25/19) and liquidation of

large long positions on Bitmex. The necessary technical rollback of about

30% has already been completed.

|

|

Second idea:

Bakkt, a subsidiary of ICE, starts trading BTC Deliverable Futures on ICE

since December 12. Recall that CBOE and CME have long had settlement BTC

futures. Now the trader, who holds Bakkt futures open until the moment of

expiration, receives a crypto currency calculation, which will allow miners

to hedge their risks. The long-term goal is to influence the positive

decision of the SEC in the topic of opening the Bitcoin ETF.

BTC Bakkt futures are prepaid until the contract is concluded, the coins are

stored in the crypto wallet of the exchange (Ice Clear US clearing), the

minimum contract is 1 BTC. The price is not limited; upon closing the

contract, the coins are returned to the client’s BTC wallet. According to

Bakkt, this asset helps the market determine the «fair» price of BTC, which

as of 10/01/19 is much lower than $10,000 - just at the current level. So,

we recommend monitoring the dynamics and

volumes

of new futures.

|

|

|